Over the last decade, the ecosystem shared by Boston-based software companies and local Engineering talent has enjoyed a steady state of growth. As we all know, 2020 has been a year unlike any in our lifetimes, as Covid-19 seemingly and in many ways literally changed everything starting in March. The effect on the local software market has been no exception.

Typically, the Market Reports authored by Planet Technology’s (formerly WinterWyman) Software Technology practice look back on recent hiring trends including market salary data, demand in specific technologies and related findings. For this edition, however, our observations of Boston’s software engineering market have us looking into the future as there have never been so many questions concerning where we are headed.

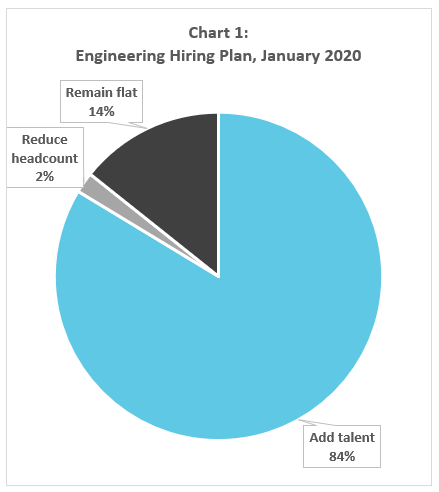

Our economy entered 2020 riding one of the strongest job markets on record, fueled by the persistent growth in the startup ecosystem and its role as job creators. As a result, 83% of the companies we polled said they planned to add Engineering headcount to their team entering 2020 (Chart 1).

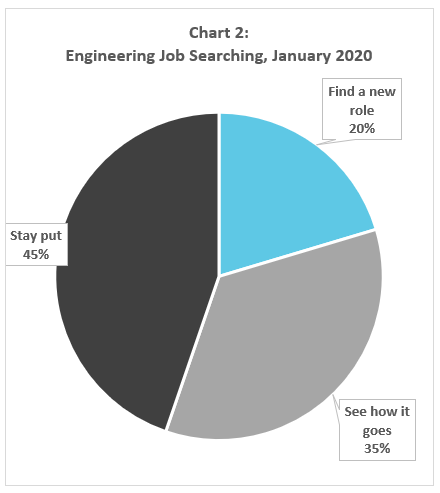

On the flip side, 45% of the Engineers polled considered themselves fully content and entrenched in their current employment at the start of the year, while only 20% planned to consider new opportunities in the next 12 months (Chart 2).

Just as these plans were taking shape, the coronavirus pandemic and start of the quarantine brought them to a screeching halt. Not only did Covid spur one of the most serious public health crises on record, the economic ramifications were significant as well – and unlike past market turbulence, Covid’s was immediate and without warning.

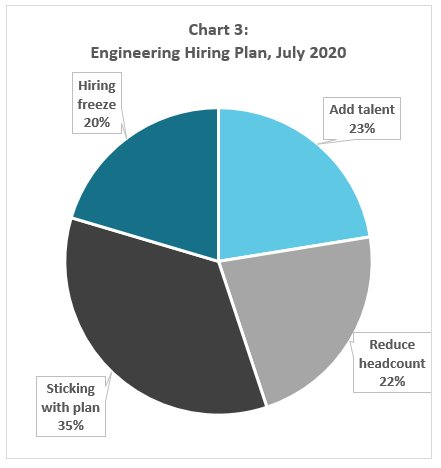

But, with Boston’s software landscape being so diverse across industry, our software job market proved to be remarkably resilient. Of companies polled in August of this year, more than 58% planned to continue hiring Engineers throughout the remaining months of 2020 (Chart 3), either due in part to their business remaining relatively unaffected by the pandemic (35%) or experiencing a tailwind effect (23%) as consumer behavior swung back towards their product offering. Also of note, only 22% of employer respondents reported having to cut Engineering staff this year.

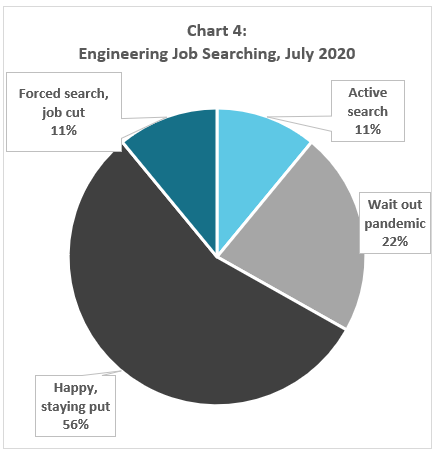

On the talent side of the spectrum, it does appear the pandemic advanced some collective sentiment to hunker down and stay put (Chart 4). But, not to the extreme one might expect.

Of Software Engineers in our network, 22% reported plans to move to a new employer during the second half of this year, albeit 11% being forced into the decision through a layoff or furlough. An additional 22% expressed a desire to find a new opportunity, but with reservations of doing so during the pandemic – a feeling that may wane as Boston continues to find success in flattening the local curve of the virus, and the volume of appealing career options available rises closer to the levels Engineers have come to expect in recent years.

One of the most encouraging findings of this report, is that during and coming out of the initial surge of the pandemic here in Boston, activity still abounds in our software job market. However, where and how we complete our work has seen a noticeable shift.

Without any warning or choice, employers have had to vacate their office spaces and become fully remote workforces. Consequently, Engineers have had to quickly embrace the work-from-home lifestyle.

In July of this year, Dice.com published a State of Remote Work report, which outlined how Covid-19 has changed the tech professional’s mindset on remote work. Of critical note to employers, the survey found 71% of technologists now consider the flexibility to work remotely, as well as employers’ eagerness to reopen offices, as now having a significant impact on their likelihood of applying or considering joining.

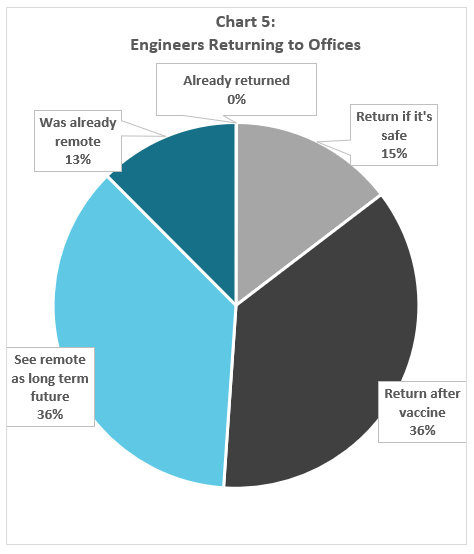

Our findings within the Boston software engineering landscape were similar as 49% of Engineer respondents view remote work as their long-term future (Chart 5); 74% of whom had not felt this way prior to the pandemic. An important point of clarity, however, was the distinction between working entirely remote vs. having the flexibility to do so a portion of the time.

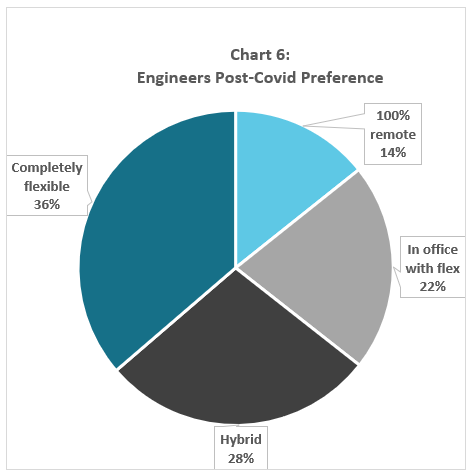

Although Engineers find the ability to work from home more important, and see positives in the experience itself, only 14% expressed a desire to be 100% remote (Chart 6). The overwhelming consensus on the ideal setup was some hybrid of a physical workspace to congregate and collaborate with other Engineers when desired, but inside a work culture that grants the flexibility to work from home a percentage of each week as well.

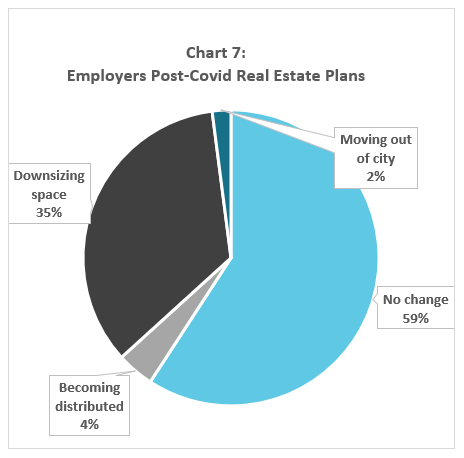

On the employer side, Boston’s software employers are moving in a similar direction. Of hiring companies surveyed, just 4% had plans to entirely vacate having an office space, but 37% intend to make significant alterations to their real estate strategy moving forward (Chart 7) – be it downsizing with less of a need to accommodate a full staff in their office on a day-to-day basis, or acquiring space outside Boston to avoid employees’ reliance on public transportation.

The extreme market turbulence of March / April 2020 and resulting job cuts within Boston Tech brought some temporary balance to our City’s (Software) Engineering supply vs. demand curve. The recovery started quickly however and is well under way.

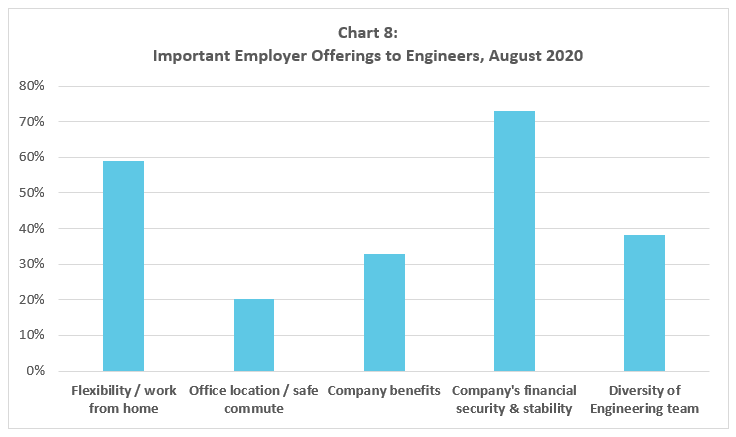

As we enter back into the candidate-starved norm our market is accustomed to, it remains critical for employers to take a thoughtful approach to best position themselves to attract top talent. Much of this means adapting with the Engineer’s evolving mindset on what’s important to them in choosing an employer (Chart 8), from having the ability to work from home when desired to the financial security and stability of their employer to working as part of a diverse Engineering team.

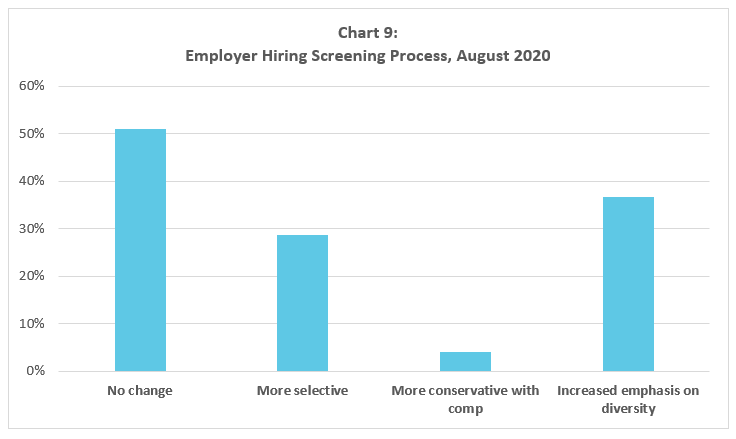

For the most part, the process of obtaining employment will look the same, as 51% of employer respondents reported no change to their screening process in response to the events of 2020 (Chart 9). Two changes of note, however, were 29% of employers preparing to be more stringent in their selection process with an eye towards being more financially responsible, as well as 37% of employers sharing plans to increase emphasis on adding diversity to their Engineering team(s).

Planet Technology’s Software Practice is a group focused on helping Boston-based technology product companies scale their Engineering teams. This entails formative involvement on both sides of the hiring market; working closely with Engineering and Talent Acquisition leadership within some of Boston’s most innovative and fastest growing tech companies as well as cultivating relationships with local Software Product Development talent, ranging from Software Engineer all the way up through CTO. The survey data included in this report was compiled by polling the contacts we have on both sides of this marketplace.

If we can help with your software talent or career needs, please don’t hesitate to contact us.

Hiring trends | Reports | Software Technology | Working remotely | Workplace